rhode island income tax withholding

Ad Fill Sign Email RI RI W-4 More Fillable Forms Register and Subscribe Now. Income other than salaries or wages sub-.

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Ad Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

. Save Time Signing Documents from Any Device. If you do not have a RI location print the form and mail it in with applicable fees Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax Only the registration for the permit. You set up your account by registering your business with the DOT online or on paper.

The income tax withholding for the State of Rhode Island includes the following changes. Permit to make sales at retail. The annualized wage threshold where the annual exemption amount is eliminated has increased from 227050 to 231500.

The income tax is progressive tax with rates ranging from 375 up to 599. These rules and regulations are promulgated pursuant to RI. An employer may withhold Rhode Islands personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding.

Hold Rhode Island income tax from the wages of an employee if. The purpose of this Part is to implement RI. What you need to know.

Any part of the wages were for services performed in Rhode Island. The employees wages are subject to Federal income tax withholding and. Rhode Island Division of Taxation One Capitol Hill Providence RI 02908.

With online registration it can take up to 4 weeks for the DOT to assign. Rhode Islands maximum marginal income tax rate is the 1st highest in the United States ranking directly below Rhode Islands. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if.

The income tax wage table has been updated. 2021 Employers Income Tax Withholding Tables PDF file less than 1 mb megabytes. Laws 44-1-4 and 44-30-95.

A Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. Latest Tax News. To register online use the DOTs Combined Online Registration Service.

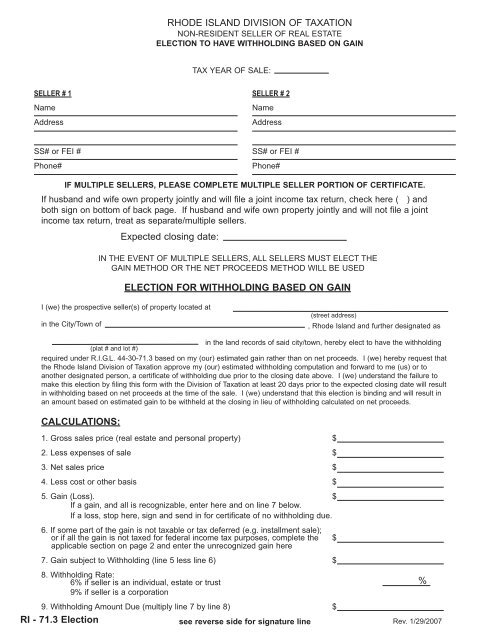

Laws 44-30-713 which provides for withholding of income tax on the sale of real estate by nonresidents. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. 2022 Filing Season FAQs - February 1 2022.

Unlike the Federal Income Tax Rhode Islands state income tax does not provide couples filing jointly with expanded income tax brackets. WEEKLY - If the employer withholds 600 or more for a calendar month. Additionally employers in other states may wish to withhold Rhode Island income taxes from wages of their Rhode Island employees as a convenience to those employees.

Estimated tax for the taxable period exceeds. The Amount of Rhode Island Tax Withholding Should Be. Fund because the amount paid or credited as.

Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf UMass employees who reside in Rhode Island use the RI-W4 form to instruct. Masks are required when visiting Divisions office. Rhode Island income tax on a current basis on.

Your actual tax liability you must file an income. 3 Even though the employees wages are NOT subject to federal income tax withholding the employer may withhold if the. Apart from your EIN you also need to establish a Rhode Island withholding tax account with the Rhode Island Department of Taxation DOT.

No action on the part of the employee or the personnel office is necessary. 5 rows Taxable Income Is. Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

A resident is defined as anyone who is domiciled in the state or who spends. The income tax wage table has changed. The Amount of the Rhode Island Tax Withholding Should Be.

1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island. This form provides a means of paying your. A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1.

The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state. The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850. Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis.

PPP loan forgiveness - forms FAQs guidance. Read the summary of the latest tax changes. The income tax withholding for the State of Rhode Island includes the following changes.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. No action on the part of the employee or the personnel office is necessary. REPORTING RHODE ISLAND TAX WITHHELD.

If you are entitled to a re-. Withholding Tax Filing Due Date Calendar 2021 2021 Withholding Tax Filing Due Date Calendar PDF file less than 1.

State W 4 Form Detailed Withholding Forms By State Chart

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Rhode Island Paycheck Calculator Smartasset

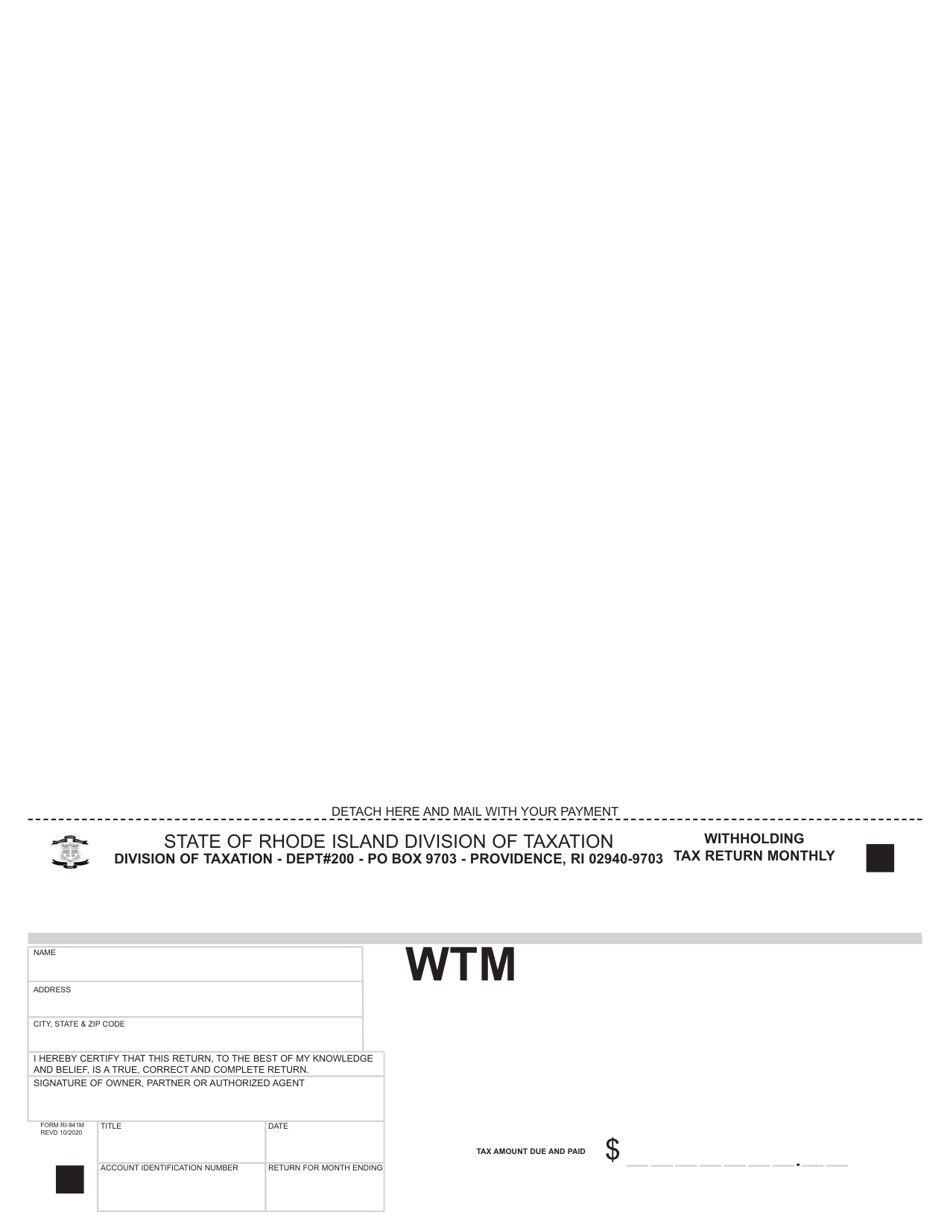

Form Ri 941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

Download Rhode Island Division Of Taxation

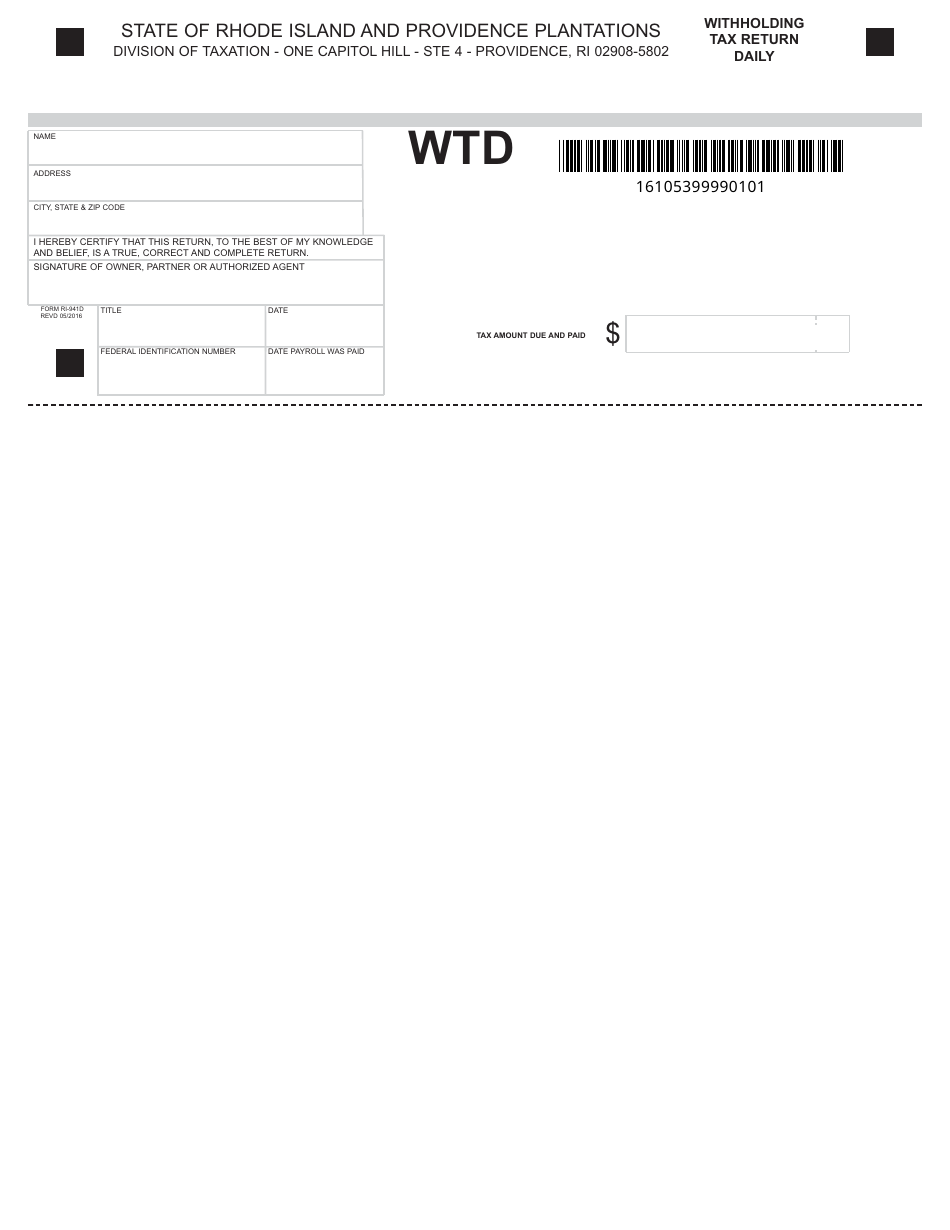

Rhode Island Withholding Tax Return Daily Download Fillable Pdf Templateroller

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Rhode Island Income Tax Ri State Tax Calculator Community Tax

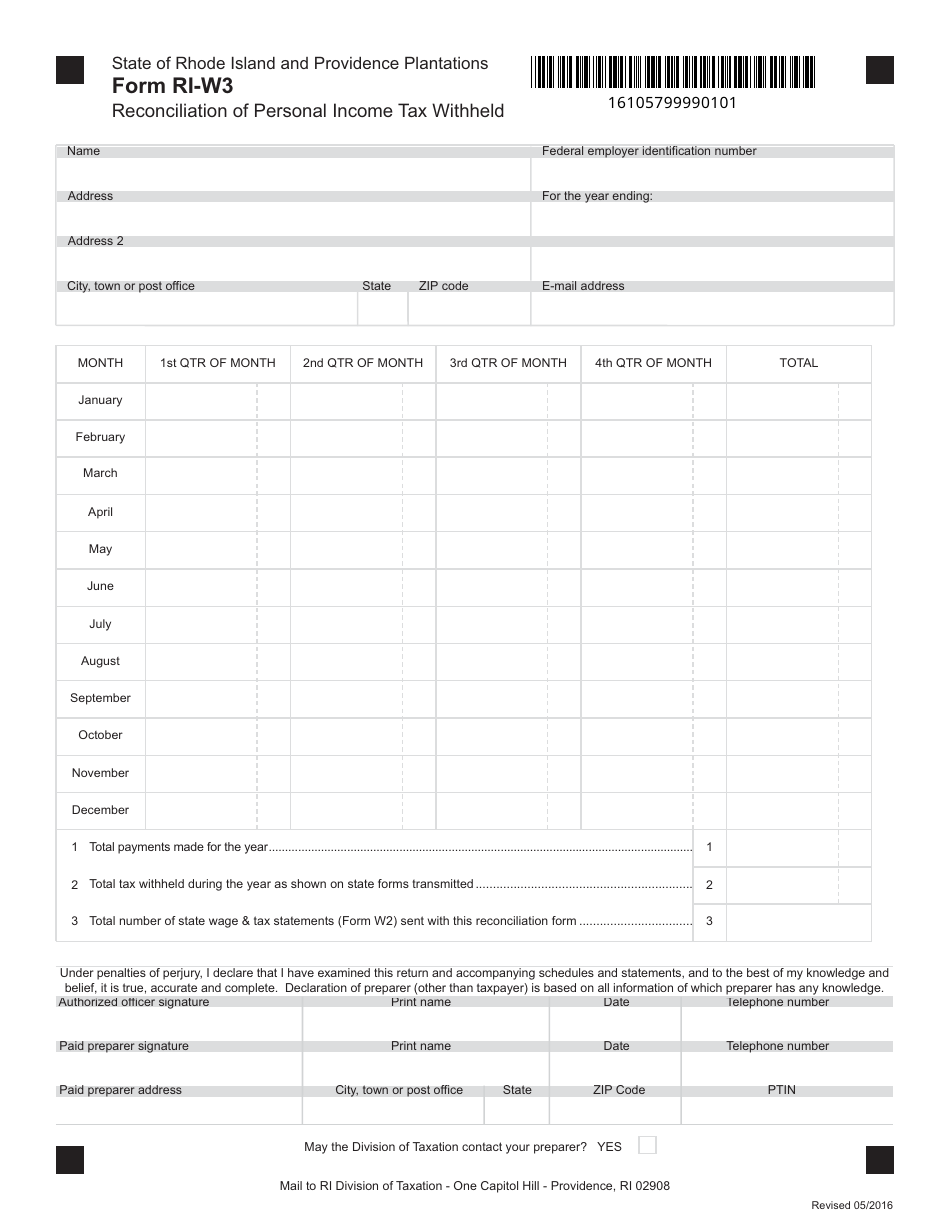

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

Build A Bear Store New York Build A Bear Store Build A Bear New York

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State Of Rhode Island Division Of Taxation Division Rhode Island Government